If your savings account pays 1% interest rates, then you are beating the country average. While that may depress you into crazy notions of hiding your greenbacks in a sock drawer, don’t be silly. That’s the first place a thief would look. Plus, your sock drawer pays a 0% return.

(Source: picsandimages.com)

You’d be better off putting it in a savings or money market account.

Don’t stockpile cash in a savings account long term. The bank would love it if you did this, but you can get a higher return for your cash in the long run if you put money in other places.

What follows are four places better than your sock drawer or bank account for growing your money.

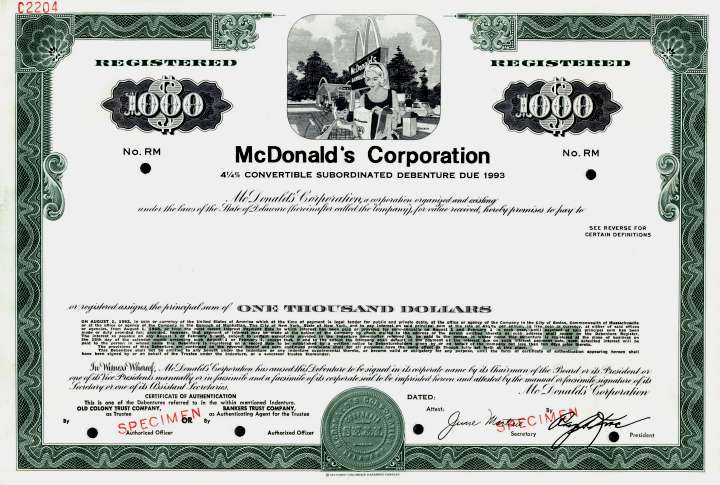

Bonds

(Source: markrosa.com)

Bonds are loans you make to businesses or the government. Unlike loans you make to friends or family, payback is more likely if you pick the right bonds.

Those debtors use your money for operations until the maturation date of the bond. Then they pay you back plus interest.

While no investment is a guarantee, bonds are generally viewed as low-risk investments.

The company could have trouble, just like an individual, but the likelihood is less. Even if they do hit hard times, they usually have contingency plans in place to cover their due diligence.

Mutual Funds

(Source: linkedin.com)

People say you should diversify your investments. What they mean is don’t put all your eggs in one basket.

For some people, mutual funds fits this play perfectly.

Fund to fund, mutual funds have different terms, but the basics are the same. Instead of investing your money in stocks for one company, mutual funds invest your money in a variety of places.

Where exactly your fund is invested, depends on how aggressively you want to grow your investment, how much risk you are willing to take.

Precious Metals

(Source: activistpost.com)

Gold, Silver or Platinum. Investors who like precious metals, like them because their rate of value increases over time so consistently it’s boring. There are peaks and valleys, but the long term values trend up.

In difficult economic times, precious metals hold their value. They are commodities, like crops or other raw materials.

The difference between precious metals and other commodities is that nobody can grow more precious metals. Nobody can print more gold.

With investments like money, if they print more of it but don’t destroy the old stuff, the value of each printed bill goes down.

Precious metals exist. They cannot be destroyed or duplicated.

Your Own Business

(Source: boyerlawfirmblog.com)

If you want to invest in something you can control, invest in yourself.

That’s how you’ll want to view investing in your own business. The gamble may be more stressful at first, but investing in yourself means you have autonomy to make your investment grow.

With all the other options above, what you can do to increase your returns is twiddle your thumbs [read: nothing].

With your own business, there’s always something you can do to drive sales.

You can offer promotions, run contests, spend money on marketing. Heck, you can stand on the street and tell every passerby about your product or service.

(Source: huffingtonpost.com)

If you’re ready to invest, talk to someone first. In fact, talk to more than one person.

Don’t make your only advisor your banker. You’re not only missing opportunities outside their sphere of control, you may be taking unnecessary risk.

Instead, speak to five investment bankers. Do more online research. Talk to your aunt who knows a lot about money. Compile all that advice into one investment plan, then make your moves.