Despite your best efforts to pay off your ugly debt, you can’t get out of this hole. The more you dig, the more you realize you’re just digging the hole beneath your feet deeper. It seems this hole will never end.

(Source: kansas.com)

FREE advice: quit digging.

Now for some straight talk. Without a decent paying job, one that covers your monthly expenses with some left over to pay down debt or save, you’ll never get ahead.

Making good money now, but don’t know where to invest? Read this: Before You Invest in Anything Take These Critical Steps

Assuming you’ve landed that good job, you’ll need to knock off a few bad habits if you want control of your life again. These are five of the worst things you’re doing to make your efforts harder than they need be.

Buying Cars

(Source: blog.dealersimplified.com)

Cars are not investments. They’re liabilities. From the moment you sign the change of ownership, your vehicle loses value. Every inch you drive that bad boy, the value depreciates. Even the risk to your health [read: $$$] skyrockets in a car.

Unless you drive your car until it’s a classic, then get lucky with your particular model rising to collectible status… assuming, of course, that you’ve taken meticulous care of your investment from bumper to bumper… only then may your car be worth more than you bought it.

Depending on where you live, there are alternatives to transit, like the bus or the train. You believe you need a car, but in many cases, you just want one.

The money you spend on gas, repairs, parking and tickets are bleeding you.

Buying in Bulk

(Source: Likeacoupon.com)

The brilliance of marketing would have you believe that buying more of something is the only way to save. Great. Now you have enough paper towel to wallpaper the Taj Mahal, except the Taj is in India and you live in Indiana.

Not only do you have too much paper towel, you have to make room to store it. Maybe you need a bigger apartment so you can store more things? Yeah, just a little more rent money will fix this problem, right?

That’s a whole bag o’ nope.

Like time, space isn’t free. Neither is your bulk-item-lifestyle.

In many cases, you could have spent the same amount by shopping around a bit, but forget about that. What is the net cost to your life shopping in bulk? How often do you buy things you didn’t need from the bulk shopping store? Beware this fallacy.

Shopping for Therapy

(Source: shoppertunity.com)

Life can feel directionless sometimes. Rather than read a book, take up a sport, go for a run, meditate or whatever else you could do for free, you shop.

You tell yourself it’s okay because you shop the discount racks and stores, but you come home with hundreds of dollars in clothes you only bought because they were the best of what you found.

You didn’t need or really have to have any of them. Sadly, you might not even wear them.

Shopping Without a Plan

(Source: savingslifestyle.com)

Before you go into any store, have a plan. Write it down or say it out loud: “I’m going in to buy _______.” Then stick to that plan.

A good trick is to avoid using a shopping cart if you can. Unless you’re grocery shopping, try to hold everything in your hands when you shop.

If you walk around with something long enough, you may come to your senses about how little it will change your life. Constantly ask yourself, “Do I really need this?”

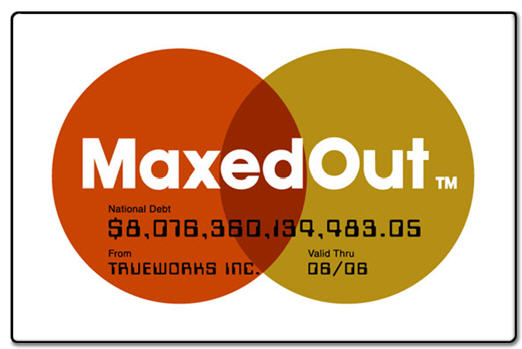

Racking Credit Cards

(Source: yoursmartcredit.com)

Credit cards are like little loans that you pay back in blood for the rest of your life. Sure, they start with tempting interest rates or free financing for one year, but eventually the man comes to collect.

Those shoes you bought on the sale rack with your credit card, the one you haven’t paid off? You’ll pay ten times over and more in the long run.

Cards can be a great way to improve your credit if you pay them back every month or before the promotional terms end, but they are not free cash.

Use your credit cards to make your life better. Read 6 Easy Free Steps You Can Take to Improve Your Bad Credit

(Source: keepcalm-o-matic.co.uk)

Get yourself into a travel plan that utilizes public transport. If you stick to it for a couple of years, the money you can put away could put you in a safer, more reliable car that you pay outright for a couple of years.

Avoid bulk stores and only buy what you need for right now. Be smart when you shop and make those credit cards work for you, not the other way around.